How Much It Cost to Buy a House in Kenya

Wondering how much it costs to buy a house in Kenya? Whether you’re a first-time buyer, returning diaspora, or investor, understanding real estate prices is key to making a smart purchase.

House prices in Kenya vary widely based on location, size, security, and property type. From budget-friendly apartments to luxury villas, here’s a clear breakdown of current market rates in 2024.

Average House Prices in Kenya (2024)

| 2-Bed Apartment | Syokimau, Ngong, Ruiru | 4M – 8M | $30,000 – $60,000 |

| 3-Bed Townhouse | Tatu City, Kitengela | 8M – 15M | $60,000 – $110,000 |

| 3-Bed Family House | Lang’ata, Kasarani | 15M – 30M | $110,000 – $220,000 |

| Mid-Range Home | Westlands, Kilimani (Nairobi) | 30M – 60M | $220,000 – $440,000 |

| Luxury House | Karen, Runda, Muthaiga (Nairobi) | 70M – 200M+ | $500,000 – $1.5M+ |

| Beachfront Villa | Diani, Nyali (Coast) | 50M – 150M+ | $350,000 – $1.1M+ |

💡 Note: Prices are for ready-to-move-in homes in secure, titled estates. Off-plan units may be 10–20% cheaper.

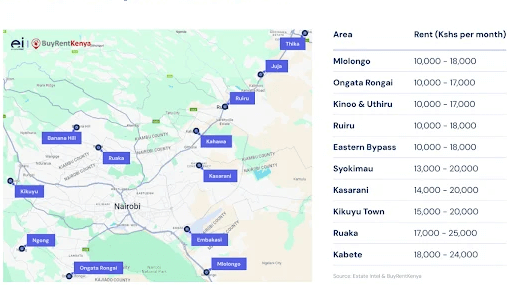

Most Affordable Areas to Buy

If you’re on a budget, consider these fast-growing, value-for-money locations:

- Syokimau – Near Jomo Kenyatta Airport, modern gated homes from KSh 4.5M

- Ngong Road / Kiserian – New developments, prices from KSh 5M

- Ruiru & Thika – Close to Nairobi, family homes from KSh 6M

- Machakos Town – Government-backed affordable housing (Pam Pam Estate)

- Naivasha – Lake views, rental potential, homes from KSh 7M

These areas offer lower entry costs and strong appreciation due to new roads and infrastructure.

Most Expensive Areas

For luxury and prestige:

- Karen – Spacious plots, top schools, security (KSh 100M+)

- Runda & Muthaiga – Elite neighborhoods with high-end finishes

- Lavington & Westlands – Central, convenient, popular with expats

- Gigiri – Home to embassies and UN agencies

These areas command premium prices due to demand, security, and lifestyle.

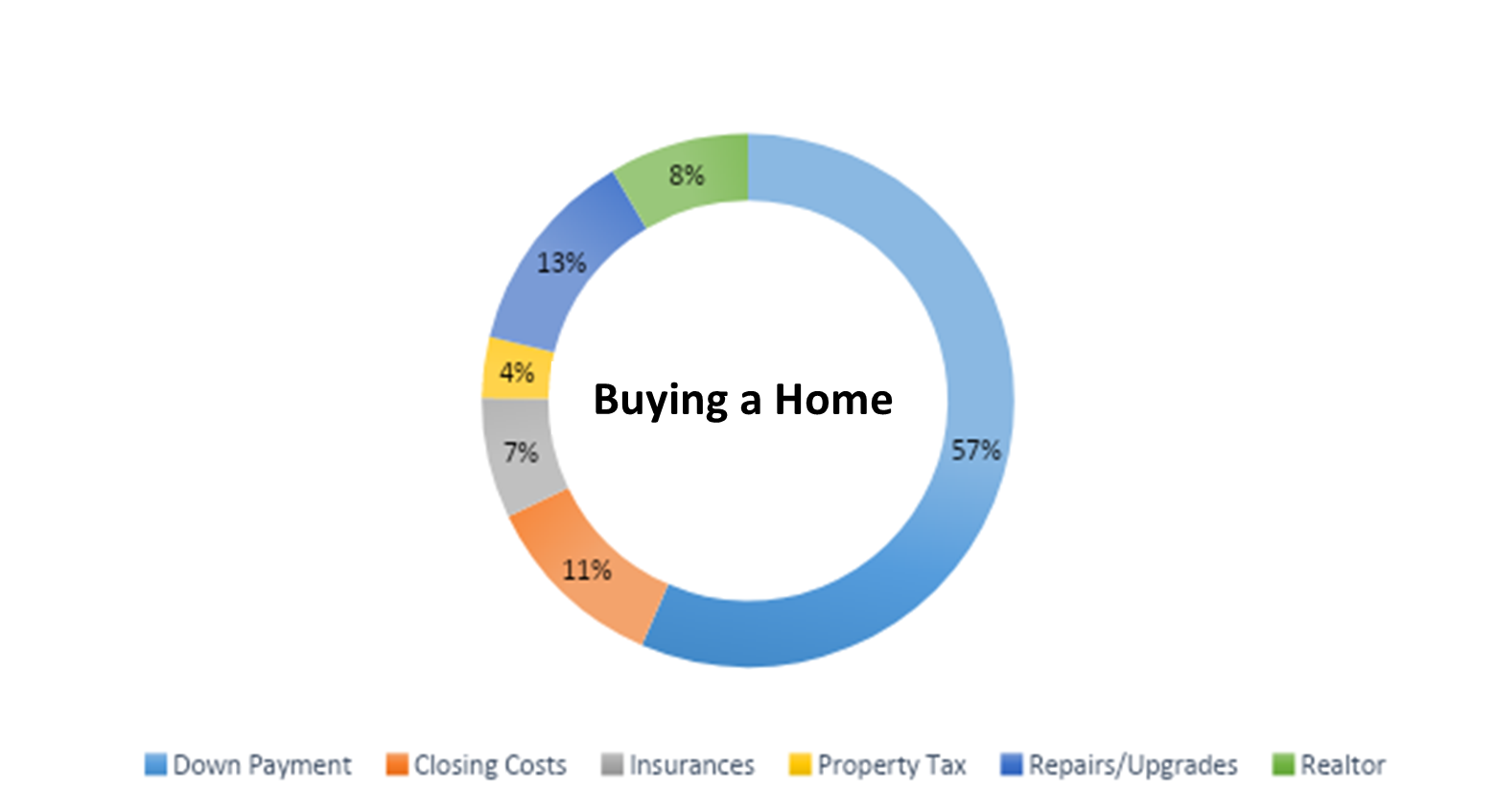

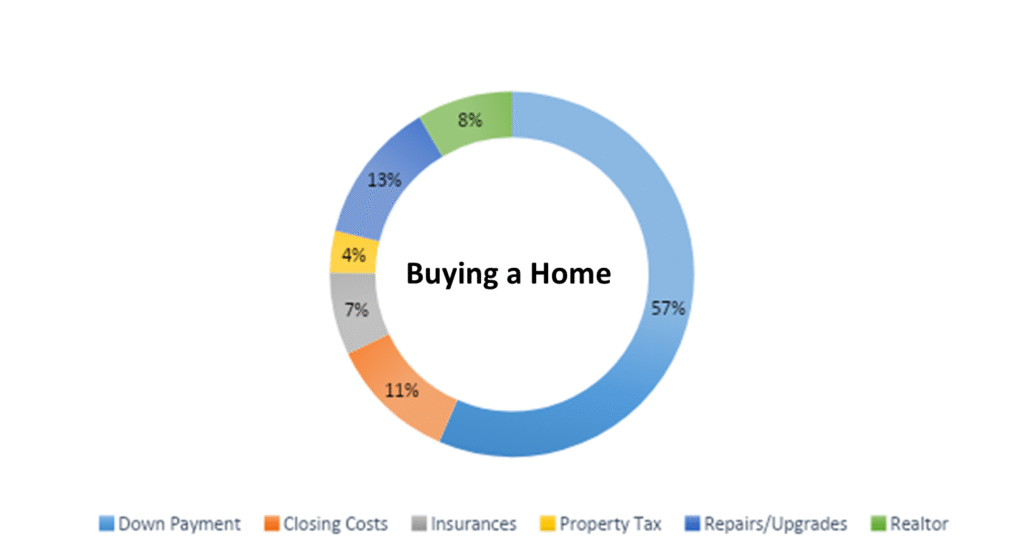

Additional Costs When Buying a House

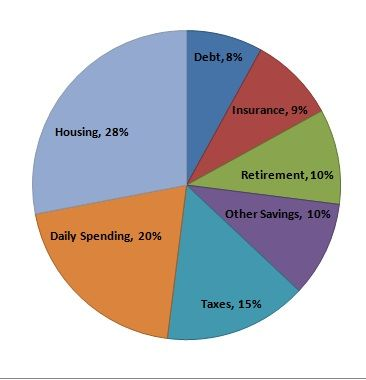

Beyond the purchase price, budget for:

- Stamp Duty: 4% (individuals) to 6% (companies) of property value

- Legal Fees: 1–2% of purchase price

- Valuation Fee: KSh 10,000 – 50,000

- Land Search & Registration: KSh 5,000 – 15,000

- Agent Commission: 5% (usually paid by seller)

- Mortgage Costs (if applicable): Processing fees, insurance, valuation

👉 Total extra costs: Typically 6–10% of the house price.

Can You Buy a House for Under KSh 5 Million?

Yes! Affordable housing projects make it possible:

- NHC (National Housing Corporation) – Units from KSh 2.5M in Machakos, Kiserian

- Private Developers – Apartments in Syokimau, Kitengela from KSh 4M

- SACCO & Bank Payment Plans – Spread payments over 3–5 years

These homes are usually 2-bedroom apartments or townhouses in secure, master-planned communities.

Key Factors That Affect Price

- Proximity to Nairobi – Closer = higher prices

- Security & Gated Access – Adds 15–30% to value

- Title Deed Type – Freehold > Leasehold

- Utilities – Properties with water, sewer, and stable power cost more

- Market Demand – Prices rise near highways, schools, and business hubs

Frequently Asked Questions (FAQs)

Q: What is the cheapest house I can buy in Kenya?

A: As low as KSh 2.5 million in government or private affordable housing projects (e.g., Pam Pam, Soweto Estate).

Q: How much deposit do I need to buy a house?

A: Typically 10–30%, depending on mortgage terms. Cash buyers pay 100%.

Q: Are house prices in Kenya rising?

A: Yes—urban and satellite town prices are increasing 5–10% annually due to demand and inflation.

Final Thoughts

The cost to buy a house in Kenya ranges from KSh 2.5 million for affordable units to over KSh 200 million for luxury estates. With smart location choices, government programs, and proper financing, homeownership is within reach for many Kenyans and foreigners alike.