Kenya Real Estate Market Size

The Kenya real estate market has emerged as a major driver of economic growth, with an estimated total market value of KSh 2.8 trillion in 2025. From residential housing to commercial developments and land investment, real estate is playing a pivotal role in urbanization, job creation, and financial inclusion across the country.

Backed by rising demand, infrastructure expansion, and government support, the sector is larger and more structured than ever before.

Total Market Valuation (2025)

| Residential Real Estate | KSh 1.9 trillion |

| Commercial Properties | KSh 600 billion |

| Land Development & Plots | KSh 300 billion |

| Total Market Size | KSh 2.8 trillion |

Source: Knight Frank Kenya, CBRE East Africa, National Housing Corporation (2025 Report)

This valuation includes:

- Completed and under-construction homes

- Serviced plots in master-planned estates

- Office spaces, retail malls, and industrial parks

- Affordable housing units under public-private partnerships

Key Market Metrics

📌 Housing Demand: Over 200,000 new homes needed annually

📌 Supply Gap: Only 50,000–60,000 units delivered per year — a deficit of 140,000+ units

📌 Affordable Housing Share: 40% of new developments target low- and middle-income earners

📌 Transaction Volume: Over KSh 350 billion in property sales recorded in 2024, up 18% from 2023

📌 Number of Active Developers: ~1,200 registered firms (Ministry of Lands data)

Contribution to the Kenyan Economy

Real estate directly contributes 6–7% of Kenya’s GDP, and up to 12% when including construction, finance, and related sectors. It also supports over 1.2 million jobs in:

- Construction & masonry

- Real estate agencies & property management

- Legal & surveying services

- Finance (mortgages, Saccos, insurance)

- Building materials manufacturing

The sector is second only to agriculture in employment generation in urban areas.

Breakdown by Property Type

1. Residential Market (KSh 1.9 Trillion)

- Apartments & Flats: KSh 900 billion

- Single-Family Homes: KSh 700 billion

- Affordable Housing Units: KSh 300 billion (growing at 25% YoY)

Top regions: Nairobi, Ruiru, Ruaka, Mombasa, Kisumu

2. Commercial Real Estate (KSh 600 Billion)

- Office Spaces: KSh 280 billion (Upper Hill, Westlands, Nairobi Business Park)

- Retail Malls: KSh 180 billion (Two Rivers, Garden City, Junction Mall)

- Industrial & Warehousing: KSh 140 billion (Athi River, Naivasa, Dongo Kundu)

3. Land & Plot Sales (KSh 300 Billion)

- 50x100ft plots in satellite towns: Average KSh 1.3 million

- Over 200,000 plots sold annually in Ruiru, Kitengela, Athi River, and Nakuru

- Popular with first-time investors and diaspora buyers

Investment Trends Driving Market Growth

✅ Diaspora Investment: Estimated KSh 45 billion poured into real estate annually by Kenyans abroad

✅ Sacco & Developer Financing: Over 60% of buyers now use flexible in-house or Sacco loans

✅ Public-Private Partnerships: NHC and county governments partnering with developers to deliver 50,000+ affordable units by 2027

✅ Digital Platforms: Jumia House, Zimasa, and Fuzu Property facilitate over 70% of initial buyer searches

Challenges Limiting Full Potential

⚠️ Financing Gaps: Only 15% of Kenyans qualify for bank mortgages

⚠️ Land Titling Delays: Some areas still face slow registration and boundary disputes

⚠️ Infrastructure Lag: Promised roads, water, and power not always delivered on time

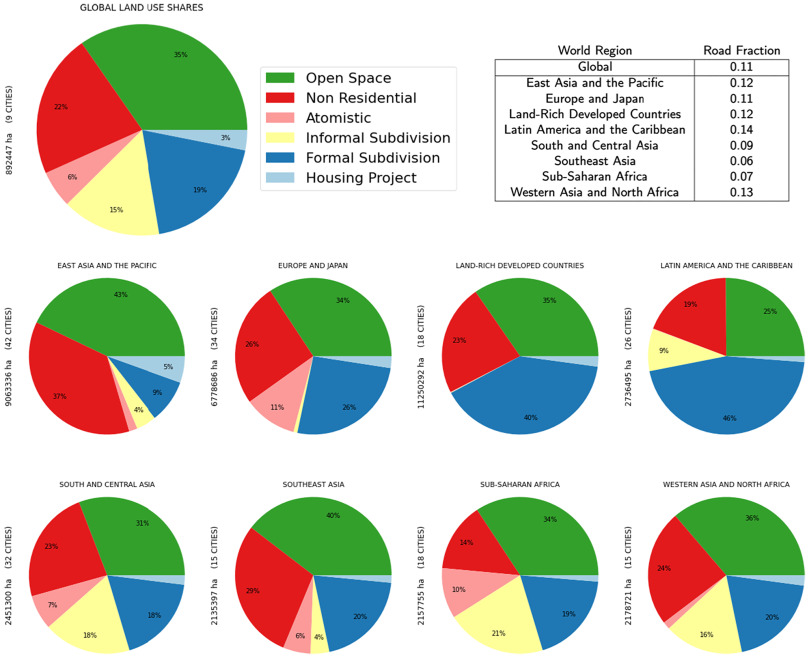

⚠️ Informal Settlements: Over 50% of Nairobi’s population lives in unplanned areas, limiting formal market reach

Future Outlook

By 2030, the Kenya real estate market is projected to reach KSh 4.5 trillion, driven by:

- Completion of LAPSSET and transport corridors

- Expansion of affordable housing

- Full digitization of land records

- Growth in green and smart buildings

With continued reforms and investment, real estate will remain a cornerstone of Kenya’s economic transformation.

FAQs

Q: How big is the real estate market in Kenya in 2025?

A: The total market size is estimated at KSh 2.8 trillion, with residential making up the largest share.

Q: What percentage of Kenya’s economy comes from real estate?

A: Direct contribution is 6–7% of GDP, rising to 12% when including construction and related sectors.

Q: How many homes are built in Kenya each year?

A: Approximately 50,000–60,000 units, far below the estimated annual demand of 200,000.