Capital Gains Tax Kenya Real Estate

When you sell a property in Kenya for a profit, you’re required to pay Capital Gains Tax (CGT) to the Kenya Revenue Authority (KRA). As of 2025, CGT is a mandatory tax on the net gain from the sale of real estate, and failure to pay can block future transactions or lead to penalties.

Understanding Capital Gains Tax on real estate in Kenya helps you comply with the law, plan your investments, and avoid surprises at closing.

💰 What Is Capital Gains Tax (CGT)?

Capital Gains Tax is a 5% tax on the profit (gain) you make when you sell a property.

- It is not a tax on the sale price, but on the net gain

- Applies to: Individuals, companies, and trusts selling land, homes, or commercial property.

- Exemptions: Limited (e.g., primary residence)

📊 How to Calculate CGT on Real Estate

Capital Gain=Sale Price−Purchase Price−Improvement Costs−Selling Costs

CGT=5%×Capital Gain

✅ Example: CGT Calculation

You sell a plot in Ruiru that you bought in 2020:

| Sale Price (2025) | KSh 3,000,000 |

| Purchase Price (2020) | KSh 1,200,000 |

| Legal & Transfer Fees (Buy) | KSh 50,000 |

| Development Costs (Fencing, Water) | KSh 100,000 |

| Agent Commission (Sell) | KSh 90,000 |

| Legal Fees (Sell) | KSh 30,000 |

| Total Deductible Costs | KSh 1,470,000 |

| Capital Gain | KSh 3,000,000 – KSh 1,470,000 =KSh 1,530,000 |

| Capital Gains Tax (5%) | 5% × KSh 1,530,000 =KSh 76,500 |

👉 You must pay KSh 76,500 to KRA before the sale is finalized.

🚫 When CGT Does NOT Apply (Exemptions)

You do not pay CGT in these cases:

| Primary Residence | If you lived in the home as your main home forat least 3 yearsbefore sale |

| Inherited Property | No CGT on inheritance (but CGT applies when the heir sells) |

| Gifts Between Spouses | Transfers between spouses are tax-free |

| Transfer to a Trust (Certain Cases) | If structured properly under tax law |

⚠️ Note: The primary residence exemption is not automatic—you must prove residency (e.g., utility bills, ID address).

📝 How to Pay Capital Gains Tax (Step-by-Step)

- Calculate Your Gain

- Gather purchase agreement, sale agreement, receipts for improvements and legal fees

- Log in to KRA iTax

- Visit https://itax.kra.go.ke

- Use your KRA PIN and password

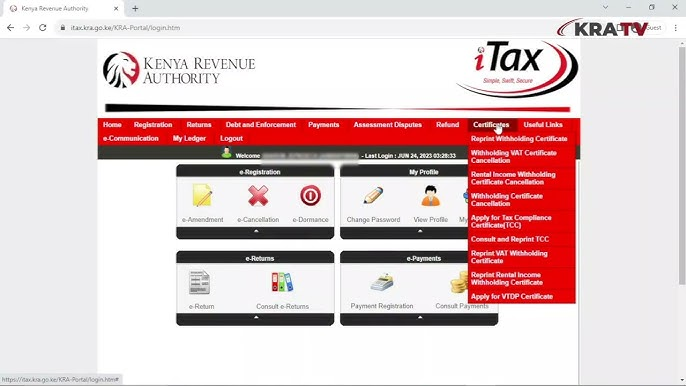

- File a CGT Return

- Go to Returns → File Return → Capital Gains Tax

- Enter:

- Sale price

- Purchase price

- Improvement & selling costs

- Gain and tax due

- Pay the Tax

- Generate a payment slip

- Pay via:

- M-Pesa (Paybill: 572572, Account: Your KRA PIN)

- Bank transfer

- Credit card

- Download & Save Receipt

- This is required for land transfer at the Ministry of Lands

✅ No CGT payment = No title transfer.

📌 Who Pays CGT?

| Individual | Yes – 5% on net gain |

| Company | Yes – 5% (but may be offset by other taxes) |

| Estate (After Death) | Heirs pay CGT when they sell |

| Trust | Trust pays CGT on gains |

⚠️ Risks of Not Paying CGT

- Blocked Property Transfer – The Ministry of Lands will not process the sale

- Penalties & Interest – 20% penalty + interest on unpaid tax

- Audit Risk – KRA can audit past transactions

- Legal Action – KRA may sue for recovery

💡 Tips for Property Sellers

✅ Keep All Receipts – For purchase, improvements, and selling costs

✅ Use an LSK Advocate – They’ll guide you through CGT and due diligence

✅ Pay CGT Early – Don’t wait until the last day

✅ Claim All Deductions – Include legal fees, agent commissions, and development costs

✅ Verify Buyer’s KRA PIN – Required for iTax filing

FAQs

Q: What is the capital gains tax rate on property in Kenya?

A: 5% of the net capital gain (profit), not the total sale price.

Q: Do I pay CGT if I sell my home?

A: No, if it’s your primary residence and you lived there for 3+ years. Otherwise, yes.

Q: Is CGT charged on land only?

A: No—CGT applies to all real estate: land, homes, apartments, commercial buildings.

Q: Can I avoid CGT by gifting property?

A: Gifting to a spouse is tax-free. Gifting to others may trigger CGT or gift tax.

Q: How do I prove my home is my primary residence?

A: Use utility bills, ID address, school records, or bank statements showing your address.

Q: Can I pay CGT via M-Pesa?

A: Yes—use Paybill 572572, Account: Your KRA PIN, and select “Capital Gains Tax”.

Final Word

Capital Gains Tax on real estate in Kenya is a non-negotiable legal requirement. While it reduces your profit, paying CGT ensures your sale is legal, transparent, and recognized by the government.